Several analyses show that due to Alberta’s demographic and economic factors, Alberta workers would receive the same retirement benefits under a provincial pension plan but pay lower contribution rates compared to what they currently pay…

Article content

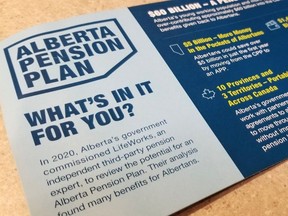

Amid a growing separatist movement in Alberta, a recent poll commissioned by the Smith government found 55% of Albertans would vote to replace the “Canada Pension Plan (CPP) with an Alberta Pension Plan that guaranteed all Alberta seniors the same or better benefits.”

Advertisement 2

Article content

Article content

Recommended Videos

Article content

That’s a massive surge in support since last year when support for a provincial plan was approximately 22%. And while there are costs and benefits to leaving the CPP, one thing is clear — Albertans could see savings under a provincial pension plan.

Oversized contributions

First, some context. From 1981 to 2022 (the latest year of available data) Alberta workers contributed 14.4% (on average) of total CPP payments while retirees in the province received only 10% of the payments, due mainly to the province’s relatively high rates of employment, higher average incomes and younger population (i.e. fewer retirees).

Over that same period, Albertans’ net contribution to the CPP — the amount Albertans paid into the program over and above what retirees in Alberta received in CPP payments — was $53.6 billion. That’s more than six times more than B.C., the only other province that paid more into the CPP than retirees in the province received in benefits. Some analysts argue the surge in support for a provincial pension plan in Alberta is a result of strategic wording by the Smith government, specifying that seniors would be guaranteed the same or better benefits than under the current CPP.

Article content

Advertisement 3

Article content

It’s true, the wording of a poll question can impact the results. But according to the federal legislation that governs the CPP, any province that wishes to withdraw from the CPP in favour of a provincial plan must provide comparable benefits.

Same for less?

And in fact, several analyses show that due to Alberta’s demographic and economic factors, Alberta workers would receive the same retirement benefits under a provincial pension plan but pay lower contribution rates compared to what they currently pay, while contribution rates would have to increase for Canadians outside Alberta (excluding Quebec) to maintain the same benefits under the CPP. More specifically, according to a report commissioned by the Smith government, Alberta’s contribution rate, which is effectively a tax taken off paycheques, would fall from the base CPP contribution rate (9.9%) to an estimated 5.85% under a provincial pension plan. That would save each Albertan up to $2,850 in 2027 (the first year of the hypothetical Alberta plan). Again, this lower contribution rate (i.e. tax) would deliver the same benefit levels in Alberta as the current CPP.

Advertisement 4

Article content

Read More

-

BELL: Most Albertans now back Alberta Pension Plan?

-

HILL: CPP another example of Albertans’ outsized contribution to Canada

Even under more conservative assumptions, Albertans would still pay a lower contribution rate while receiving the same benefits. According to economist Trevor Tombe’s estimate, Alberta’s contribution rate would drop to 8.2% and save Albertan workers approximately $836 annually.

Support for a separate provincial pension plan is on the rise. And Albertans should know that under an Alberta plan, due to demographic and economic factors, they could pay a lower contribution rate yet receive the same level of benefits.

Tegan Hill is director of Alberta policy at the Fraser Institute.

Article content