‘The bank of mum and dad’ is significantly impacting the UK housing market, enabling first-time buyers to purchase properties much earlier and at higher price points, according to a new analysis by UK Finance. The growing trend is also raising concerns about deepening inequalities in homeownership.

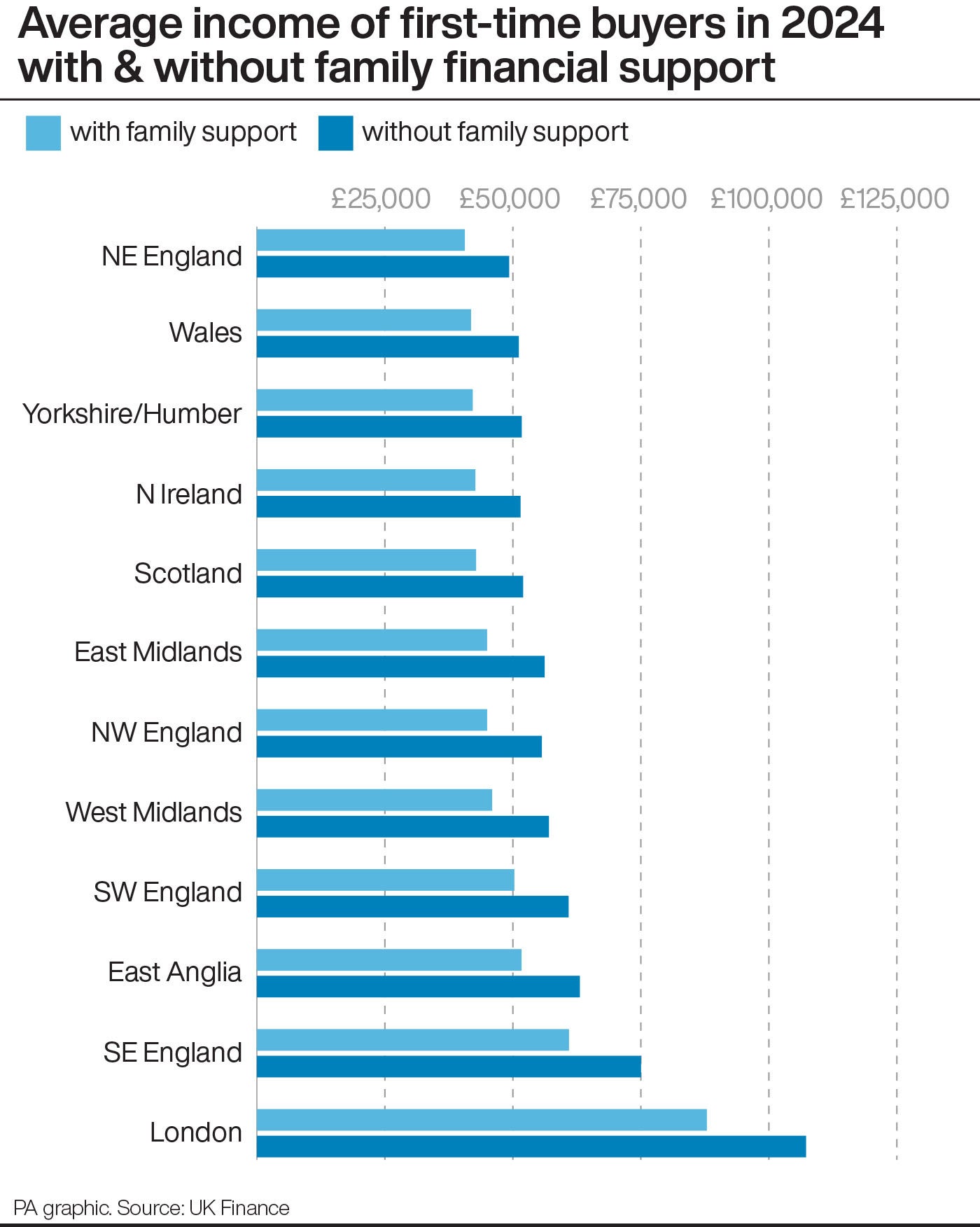

The analysis compared “assisted” first-time buyers – those likely receiving financial help from family – with “unassisted” buyers in 2024.

UK Finance used loan data modelling to estimate which buyers had deposits realistically saved from their income, and which had deposits potentially boosted by family contributions.

The findings reveal a stark contrast in purchase power. Assisted buyers enter the market around age 30, with an average household income of £56,000.

They typically purchase homes worth nearly £40,000 more than their unassisted counterparts. Unassisted buyers, despite having a higher average household income of £65,000, tend to buy later, at around age 32.5.

This difference highlights the significant advantage conferred by family support, allowing younger buyers to overcome affordability hurdles and access higher-value properties, despite lower earnings.

UK Finance warns that this growing reliance on family support risks exacerbating existing inequalities within the housing market.

The average deposit put down by buyers with family help is £118,073 and the average amount put down by unassisted first-time buyers is £60,741.

Across the UK, the average purchase price for buyers who have family assistance is £317,846 and the average price paid for those without this extra support is £279,381.

The difference in deposit amounts is particularly pronounced in London, the analysis found.

In 2024, a first-time buyer purchasing a home in London without family support typically put down a deposit of £145,133. But among those receiving family assistance, the average deposit was £224,054.

UK Finance also looked at the impact of a temporary stamp duty holiday, introduced during the coronavirus pandemic.

It appears to have had uneven effects, particularly helping those who could also get help from the bank of mum and dad, UK Finance said.

It found a disproportionate increase in the number of assisted first-time buyers.

The policy also coincided with a notable increase in borrowers withdrawing sizeable amounts of equity when remortgaging, suggesting that some households were drawing on their own property wealth to help family get on the housing ladder, UK Finance said.

On Thursday this week, the Bank of England reduced the base rate to 4.25%, from 4.5%.

Housing market experts have suggested the rate cut could help to inject more buyer interest into the housing market, with several lenders having already introduced more mortgages with sub-4% rates.

James Tatch, UK Finance’s head of analytics, said: “First-time buyers are essential to the UK housing market, helping to unlock transactions further up the chain and maintain overall liquidity.

“While the majority of first-time buyers are still managing to purchase without help, the growing reliance on family support risks deepening inequality in the housing market. A balanced approach which addresses both supply and affordability issues is essential to ensure the door to home ownership remains open to all.”

Toby Leek, NAEA (National Association of Estate Agents) Propertymark president, said: “These figures demonstrate that there is still much work to be done to help first-time buyers get onto the property ladder, and that for many people under the age of 30, homeownership is not a realistic aspiration without financial support from parents.”

Henry Jordan, Nationwide Building Society’s director of home, said: “First-time buyers are vital to the housing market and economy, but home ownership remains a challenge for many without additional support.

“Alongside building a deposit, many also struggle to borrow enough.”

He said Nationwide’s Helping Hand deal, which gives first-time buyers the ability to borrow up to six times income at up to 95% loan-to-value, has helped more than 55,000 customers since its launch in 2021.

Here are home purchase prices, deposit sizes and ages for first-time buyers with and without assistance, according to UK Finance:

East Anglia

Assisted buyers: £286,957 value, £102,340 deposit, age 30.0

Unassisted buyers: £273,723 value, £56,060 deposit, age 32.4

East Midlands

Assisted: £237,872, £80,486, 29.5

Unassisted: £229,565, £41,788, 32.3

London

Assisted: £546,972, £224,054, 31.7

Unassisted: £145,133, 33.9

North East

Assisted: £189,455, £66,176, 28.7

Unassisted: £167,161, £29,918, 31.3

North West

Assisted: £231,697, £82,579, 29.8

Unassisted: £212,871, £40,262, 32.2

Northern Ireland

Assisted: £205,514, £87,177, 29.9

Unassisted: £183,571, £40,165, 32.3

Scotland

Assisted: £203,450, £72,267, 28.5

Unassisted: £182,442, £36,882, 31.6

South East

Assisted: £359,719, £127,833, 30.7

Unassisted: £347,481, £71,951, 33.2

South West

Assisted: £288,601, £104,071, 30.3

Unassisted: £275,911, £58,882, 32.5

Wales

Assisted: £212,558, £75,985, 29.7

Unassisted: £193,640, £35,551, 31.8

West Midlands

Assisted: £248,705, £87,239, 30.2

Unassisted: £235,819, £45,037, 32.6

Yorkshire and the Humber

Assisted: £214,354, £75,357, 29.2

Unassisted: £196,711, £37,809, 31.5

UK Average

Assisted: £317,846, £118,073, 30.2

Unassisted: £279,381, £60,741, 32.5