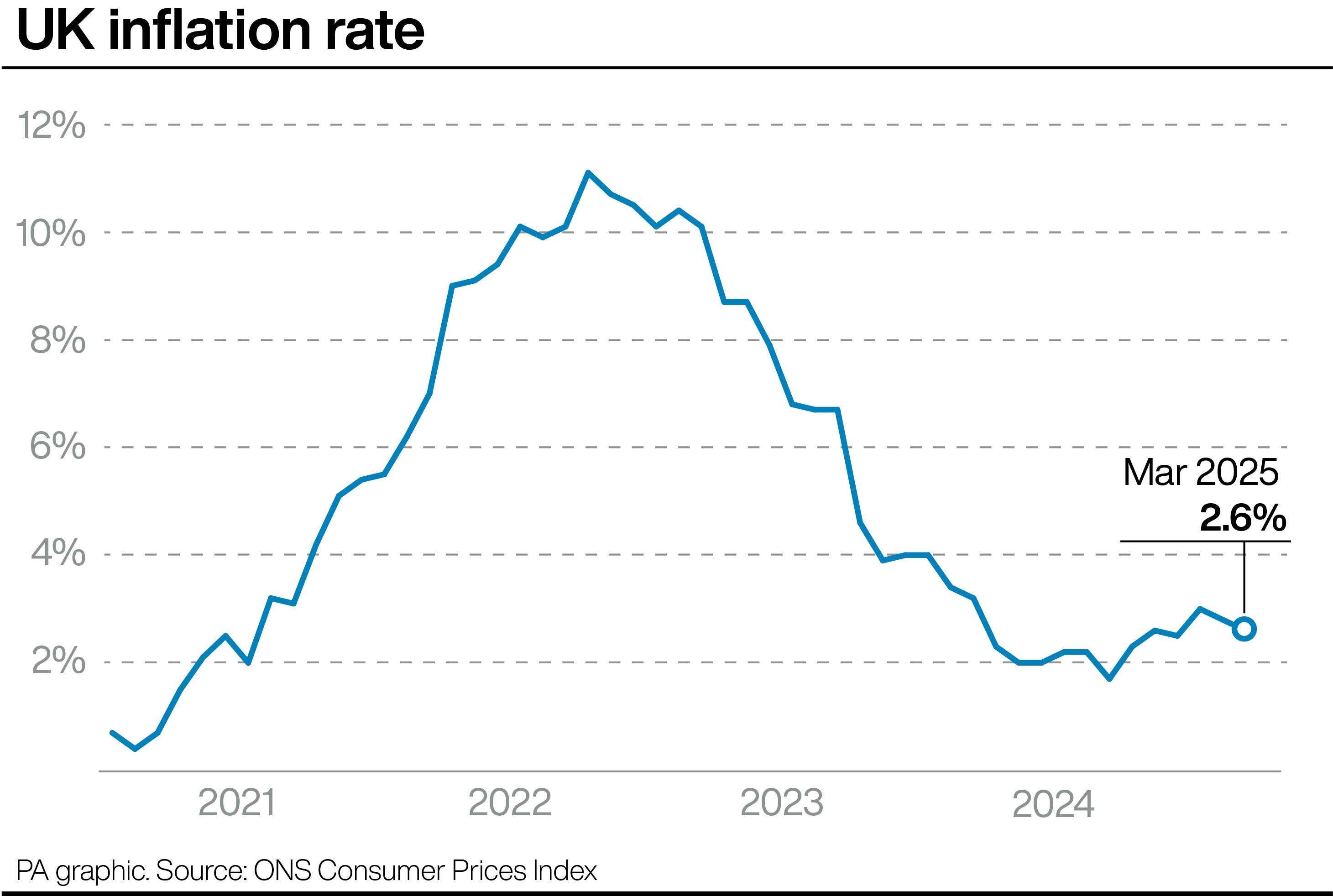

UK inflation shrank for the second consecutive month in March to 2.6 per cent, official figures show. The Office for National Statistics (ONS) said the rate of Consumer Prices Index (CPI) inflation eased to the new rate from 2.8 per cent in February.

This was a slightly bigger drop than economists had predicted, with most forecasting a figure of 2.7 per cent. It marks the lowest reading since December in news that will no doubt be welcome to households grappling with high prices.

There are a number of factors involved in the headline inflation figure and just because it has fallen overall does not mean that things are getting cheaper across the board.

ONS chief economist Grant Fitzner said: “Inflation eased again in March, driven by a variety of factors including falling fuel prices and unchanged food costs compared with the price rises we saw this time last year.

“The only significant offset came from the price of clothes, which rose strongly this month, following the unusual decrease in February.”

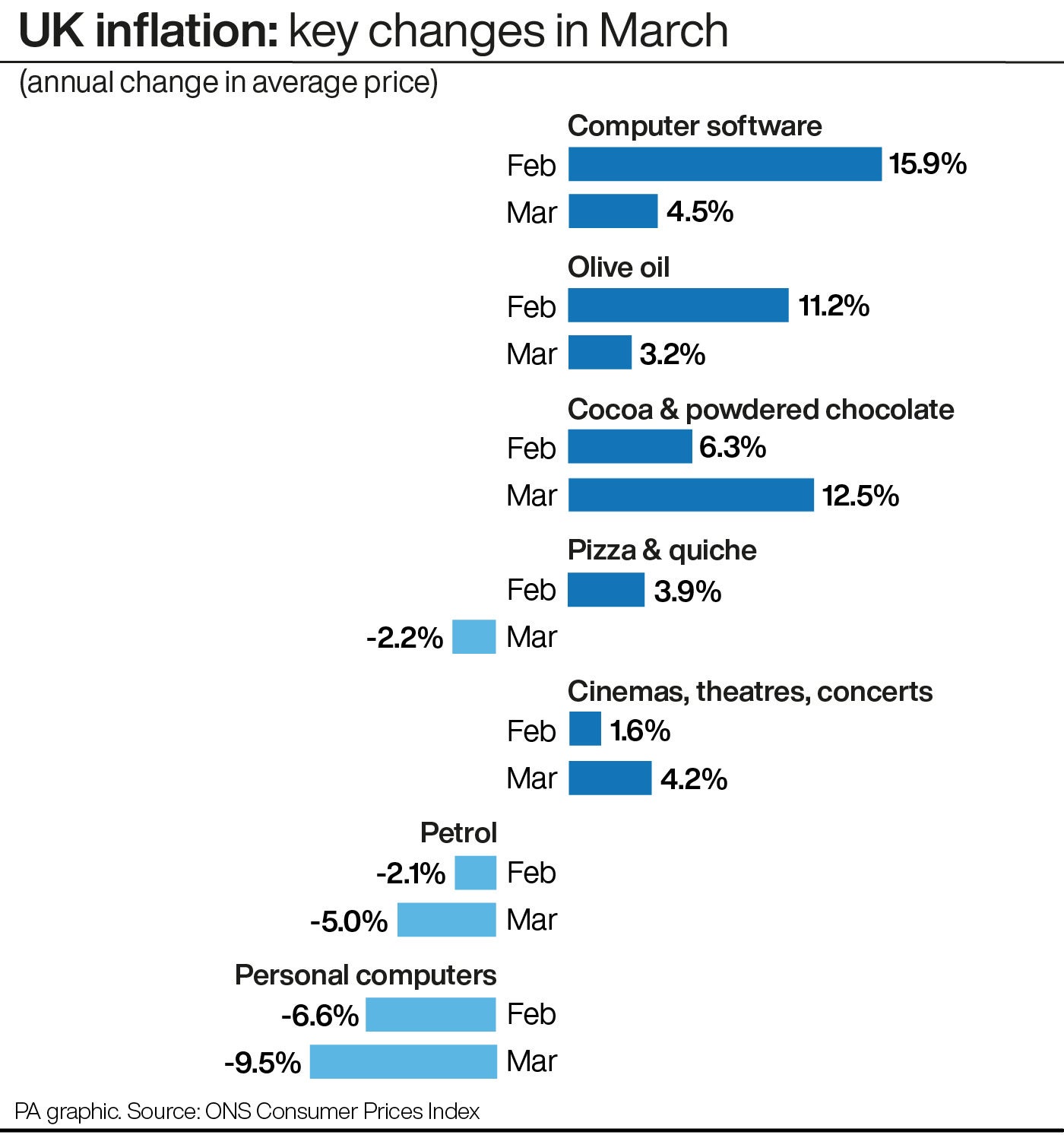

Falls in the cost of personal computers also helped ease the overall rate of inflation, while prices accelerated for cinema tickets, women’s clothes and – ahead of Easter – cocoa and powdered chocolate.

The average cost of petrol last month was 5 per cent lower than it was a year earlier, a larger drop than the 2.1 per cent fall seen in February.

Diesel also enjoyed a sharper decline, down 6.0 per cent year on year in March compared with a fall of 3.2 per cent in February, according to the official figures.

Among everyday groceries, prices fell faster in March for rice (down 4.7 per cent year on year) than in February (down 3.1 per cent), as they did for fish (down 2.2 per cent in March, down 0.7 per cent in February) and jam and marmalade (down 3.0 per cent in March, down 1.1 per cent in February).

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

Go to website

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

Go to website

The cost of pizza and quiche saw a big swing from positive inflation in February (up 3.9 per cent year on year) to negative inflation last month (a 2.2 per cent drop).

Several items saw prices continuing to rise, but at a slower rate – for example, olive oil, which was up 3.2 per cent year on year in March compared with 11.2 per cent in February, and mineral water, up 1.9 per cent in March following a jump of 4.1% in February.

One of the sharpest slowdowns in inflation was for computer software.

Here, prices rose by 4.5 per cent year on year in March – a sizeable increase, but one that was much smaller than the huge 15.9 per cent jump recorded in February.

The average price of a personal computer was down 9.5 per cent year on year last month, a bigger drop than the 6.6 per cent fall in February.

One of the largest movements in the other direction was for cocoa and powdered chocolate, where prices were up 12.5 per cent year on year, compared with a more modest jump of 6.3 per cent in February.

Shoppers are likely to see this reflected in an increase in the cost of Easter eggs and related treats.

The average price of a cinema, theatre or concert ticket was up 4.2 per cent year on year in March, larger than the 1.6 per cent increase in February.

Women’s clothes have swung from positive annual inflation in January (up 4.2 per cent) to negative inflation in February (down 0.2 per cent) then back to positive inflation in March (up 2.7 per cent).

Potatoes, cheese, breakfast cereals and yoghurt all saw an acceleration in inflation last month, as did the cost of both new and second-hand cars.

Below are some examples of how the Consumer Prices Index (CPI) inflation rate has eased or accelerated.

Two figures are listed for each item – the average rise in price in the 12 months to February, followed by the average rise in price in the 12 months to March.

Where has annual inflation eased?

- Software: February up 15.9 per cent, March up 4.5 per cent

- Olive oil: February up 11.2 per cent, March up 3.2 per cent

- Pizza and quiche: February up 3.9 per cent, March down 2.2 per cent

- Personal computers: February down 6.6 per cent, March down 9.5 per cent

- Sugar: February up 0.8 per cent, March down 1.4 per cent

- Hotels and similar accommodation: February up 0.9 per cent, March down 1.3 per cent

- Mineral or spring waters: February up 4.1 per cent, March up 1.9 per cent

- Jams, marmalades and honey: February down 1.1 per cent, March down 3.0 per cent

- Coffee: February up 8.6 per cent, March up 6.7 per cent

- Rice: February down 3.1 per cent, March down 4.7 per cent

- Fish: February down 0.7 per cent, March down 2.2 per cent

- Eggs: February up 5.0 per cent, March up 4.1 per cent

- Bread: February up 1.4 per cent, March up 0.6 per cent

- Crisps: February up 3.2 per cent, March up 2.5 per cent

- Fruit: February up 4.2 per cent, March up 3.6 per cent

Where has annual inflation accelerated?

- Cocoa and powdered chocolate: February up 6.3 per cent, March up 12.5 per cent

- Margarine and other vegetable fats: February down 2.4 per cent, March up 1.9 per cent

- Yoghurt: February down 1.2 per cent, March up 2.3 per cent

- Women’s clothes: February down 0.2: March up 2.7 per cent

- Cinemas, theatres, concerts: February up 1.6 per cent, March up 4.2 per cent

- Potatoes: February up 3.2 per cent, March up 5.5 per cent

- Cheese and curd: February up 2.1 per cent, March up 4.0 per cent

- Children’s clothes: February down 2.5 per cent, March down 0.7 per cent

- Pasta and couscous: February down 5.3 per cent, March down 4.0 per cent

- Breakfast cereals: February up 1.6 per cent, March up 2.8 per cent

- New cars: February up 2.3 per cent, March up 3.1 per cent

- Second-hand cars: February no change, March up 0.6 per cent